Part 1: Commodities: Are we already seeing the beginning of a long-term cycle of rising prices?

Monetary policy reversals by major central banks, record-high inflation, and uncertainty due to tight supply chains and sanctions against Russia have led to massive volatility across nearly all asset classes. The market movements represent opportunities for trading-oriented investors. The days when adequate returns could be achieved with buy-and-hold strategies due to stable macroeconomic conditions seem to be over for now. To capitalize on the opportunities, however, a reliable, precisely tailored data supply plays a much bigger role.

Part 1: Commodities: Are we already seeing the beginning of a long-term cycle of rising prices?

In contrast to past cycles, the prices of almost all goods have recently risen sharply. This is an important difference from previous developments, such as in the 2000s, when only certain commodity prices increased. In addition, the rise in the prices of many commodities is not due to speculative buying but to genuine demand from the real economy.

Take renewable energies, for example: without raw materials, there are no solar plants, no electric cars and no wind turbines. The production of one turbine requires up to 30 tons of copper and one ton of rare earths. According to the International Energy Agency (IEA), a modern photovoltaic system requires twice as many metallic raw materials as a coal-fired power plant with a similar output. This is of great significance, particularly for Germany, because the share of renewable energies is expected to double worldwide by 2050. In Germany, electricity is to be generated entirely from renewable sources by 2035.

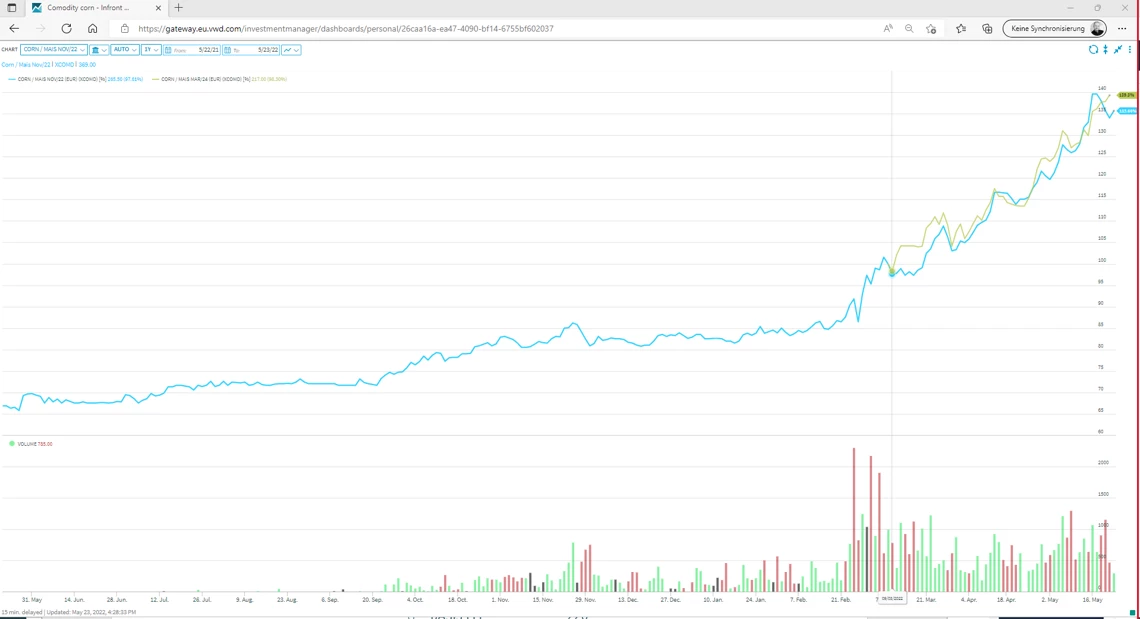

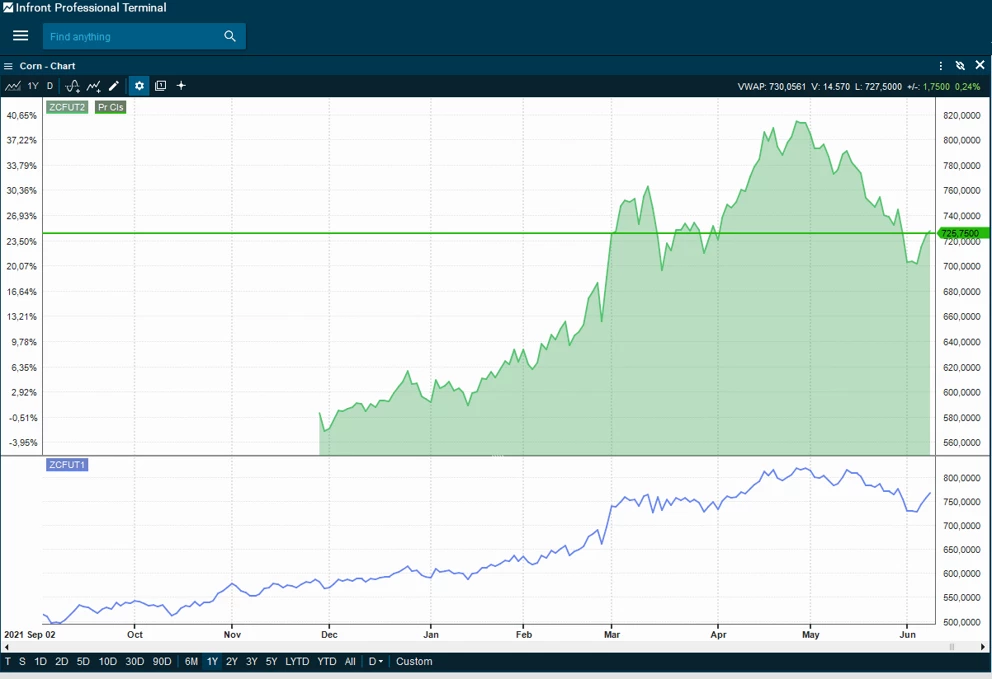

The demand for many commodities is already so high that there is a widespread shortage, which can be seen in the so-called backwardation of commodity futures: their current prices are higher than the prices of comparable contracts for future delivery, as indicated by positive carry figures.

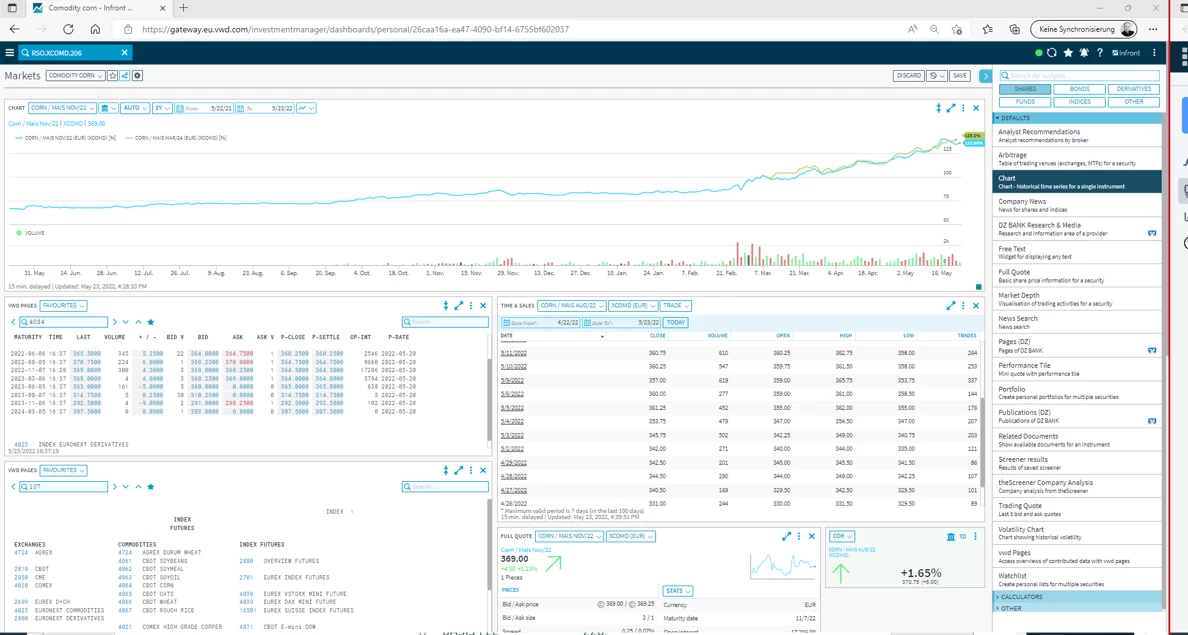

Infront Investment Manager: SYMBOL: EMA.XCOMD.206, EXCHANGE: XCOMD, NAME: Euronext Commodities/Chart: Corn/Mais NOV/22 vs Corn/Mais MAR/24

Infront Investment Manager: SYMBOL: EMA.XCOMD.206, EXCHANGE: XCOMD, NAME: Euronext Commodities/Chart: Corn/Mais NOV/22 vs Corn/Mais MAR/24

Infront Investment Manager: SYMBOL: EMA.XCOMD.206, EXCHANGE: XCOMD, NAME: Euronext Commodities/Chart: Corn/Mais NOV/22 vs Corn/Mais MAR/24

This points to strong demand, low supply, and low inventories, which in the past usually suggested high earnings potential. Moreover, the backwardation in commodities is currently broad-based - a phenomenon not seen for years. From historical experience, it should be noted that commodity cycles can last for several years. To meet high demand with higher supply, years of preparation are usually required to develop and exploit new sources.

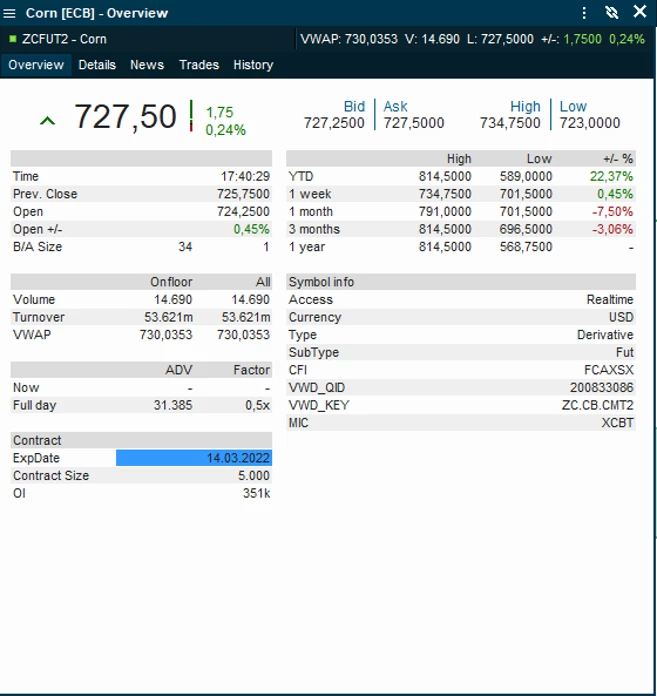

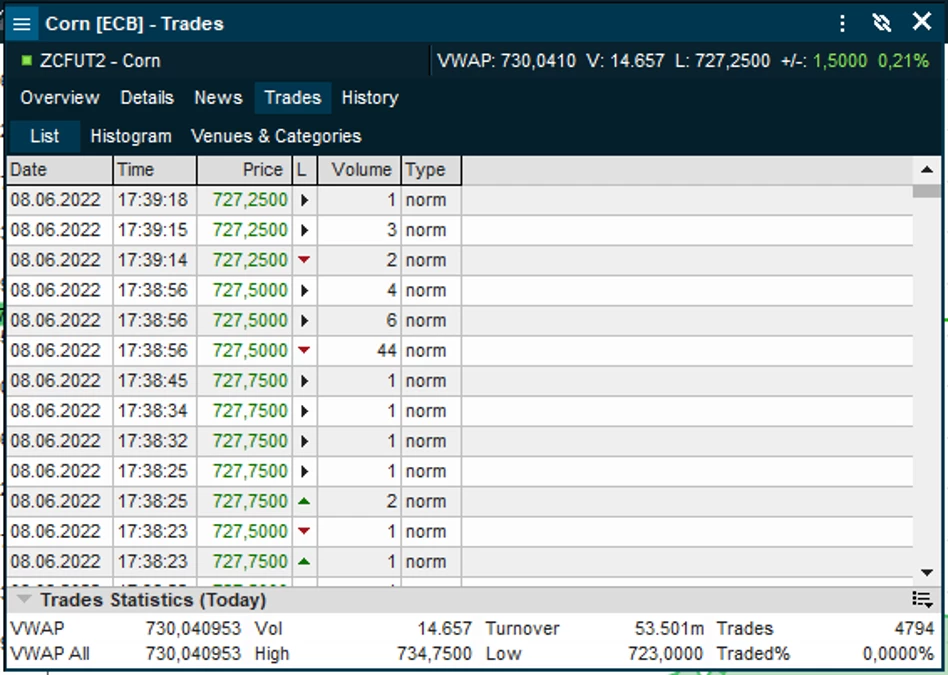

Infront Professional Terminal: Exchange: CBOE (Chicago), Instrument: current and next Corn Future

Infront Professional Terminal: Exchange: CBOE (Chicago), Instrument: current and next Corn Future

Infront Professional Terminal: Exchange: CBOE (Chicago), Instrument: current and next Corn Future

Supported by Tobias Hartmann, Infront

Back to all news

Back to all news